Many factors affect the cost of auto Nicholson Insurance. Some of them are obvious, such as the make and model of your car. Others are less apparent, such as your age and driving record.

Full coverage provides more protection for your vehicle but is also more expensive than minimum coverage. It is advisable to purchase full coverage if you have significant assets that you want to protect.

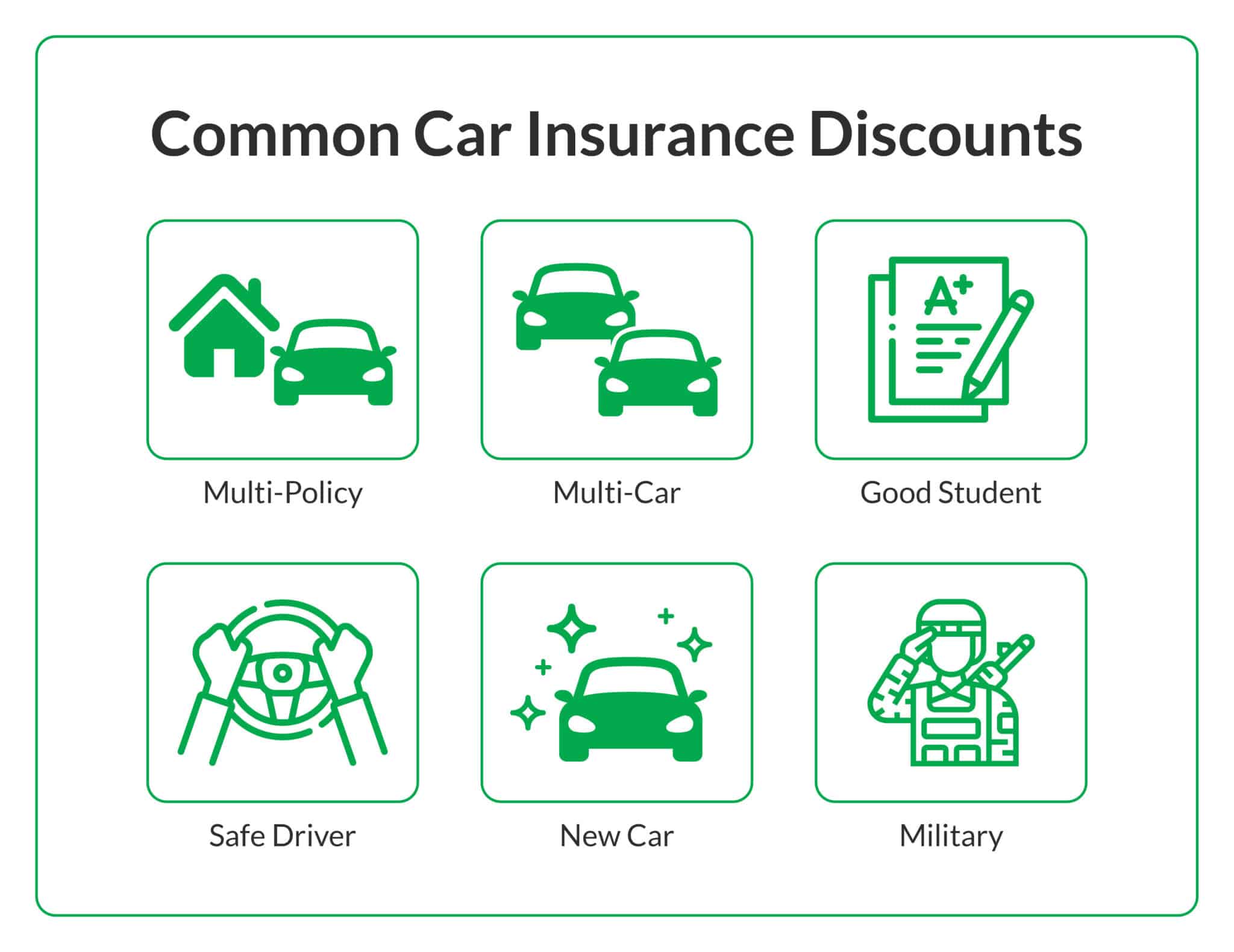

The cost of car insurance is a big consideration for many drivers. Most states mandate a minimum amount of auto insurance, and people often purchase additional coverage to protect their vehicles. In addition, the lender of a vehicle loan or lease may require that you carry specific types of coverage. The type of car you drive, and your driving record can also impact the price of a policy. Drivers with clean records can often enjoy lower rates, and some insurers reward safe driving with discounts over time.

The type of car you drive can have a huge impact on the cost of your premium. For example, a brand new sports car is typically more expensive than a five-year-old sedan. Similarly, a high-performance car can be much more expensive to insure than an economy vehicle. A higher deductible can reduce the price of your premium, but you’ll need to be sure that you can afford to pay the deductible in the event of a claim.

Another factor that affects the cost of auto insurance is your credit score. A poor credit score can lead to much higher costs than a good one. Insurers use a special credit-based insurance score that differs from the traditional credit scores from companies. The insurance credit tier you are placed in is based on your credit history, including recent late payments and bankruptcies.

Insurers use other factors, such as your driving history and age, to determine your risk. For instance, younger drivers tend to pay more than older drivers. Gender is also a factor, with men paying more than women for the same coverage. People with serious driving violations, such as DUIs or major accidents, may be required to carry more comprehensive policies and pay higher rates.

The location of your home and work can also have an impact on the cost of your policy. Insurers take into account the likelihood of damage to vehicles in each area, along with any crime statistics. For example, some areas have more traffic incidents or more frequent hailstorms than others.

Coverage

In exchange for a premium, an insurance company agrees to pay your losses as outlined in the policy contract. Typically, auto insurance policies cover liability and property damage. Some states also require drivers to carry medical coverage for themselves and their passengers.

Liability coverage pays for the other driver’s car repair bills and medical expenses if you are found to be at fault in an accident. It may also cover legal fees if you are sued. Most states require a minimum of $25,000 worth of liability coverage.

Collision insurance pays to repair your vehicle if it hits another car or object, such as a tree, guardrail, wall or building. It can also pay for damage from an animal strike, windstorm or rollover. Some lenders require that you have collision insurance if your car is financed or leased.

Comprehensive insurance helps to repair your vehicle if it’s damaged by other factors, such as theft, vandalism or weather events. It can also help cover rental car costs or other transportation if your vehicle is in the shop for an extended period of time. Some people choose to add this coverage to their policies.

Medical payments coverage helps pay for reasonable medical and funeral expenses for you and your passengers if they are injured in an accident, regardless of who is at fault. It can also cover x-rays and surgery costs. Some state laws require this coverage.

Roadside assistance coverage helps pay for services like towing, flat tire changes, jump starts and fuel delivery. It is sometimes included with other policies, such as comprehensive or collision insurance, or it can be purchased separately.

Usage-based insurance (UBI) is a type of car insurance that allows drivers to customize their premiums by monitoring how, when and where they drive. It is often cheaper than traditional auto insurance because it rewards safe driving habits with lower rates. The insurance company tracks driving data through a device that plugs into the car’s on-board diagnostic (OBD-II) port or via a mobile app. It takes into account things like speeding, hard braking and phone usage.

Deductibles

A car insurance deductible is the amount that a policyholder must pay before the insurer starts to pay on a covered claim. It is an upfront cost that is part of the trade-off for lower annual, biannual or monthly premium payments. Choosing a higher deductible can save the policyholder money, but the downside is that the policyholder will have to shell out more money in the event of an at-fault accident or other claim.

Typically, the deductible is selected when the policy is purchased, though it can be changed at any time. WalletHub notes that a high deductible can make sense if the policyholder has savings that would cover the difference in the event of an accident, or if they live in an area prone to floods, hailstorms and other natural disasters that could damage their car. However, a low deductible may not make sense if the policyholder has an older vehicle with a low value.

Some insurers offer a “vanishing deductible” feature, which allows the deductible to reduce over time, depending on the policyholder’s driving record and other factors. For example, the deductible might go down $100 for every year that the policyholder stays accident-free. This can be a good incentive for safe drivers who want to avoid paying a high deductible for the long term. For other drivers, a high deductible might be worth it if they are comfortable with the risk of having to pay a large sum out of pocket in case of an accident. This is especially true for those who rarely file a claim. They can expect to recoup the cost of their deductible within three years of an accident, according to WalletHub. This makes it even more important for them to compare quotes and choose a policy with the best deductible options.

High-risk drivers

When an insurance company categorizes you as high risk, it means that they see you as a driver with a greater than average possibility of filing a claim. These drivers are typically charged more for their coverage than those who do not have this designation. While most companies will base their determination on a number of factors, the majority will use your driving record and credit score to determine your risk level.

New and teen drivers are generally seen as higher risks than those with years of clean driving behind them. However, it is important to note that one minor accident or speeding ticket won’t automatically place you into the high risk category. You will likely only be classified as this if you have multiple tickets or at-fault accidents on your record. This designation may also be attached to drivers who have been convicted of a serious violation, like a DUI.

There are a few things you can do to help reduce the amount of time you’re considered high risk for. This includes being sure that you pay your premium on time and in full. This will help keep your credit from getting worse and may even improve it if it’s already low. You can also work to be a better driver. This will not only be good for you, but other drivers on the road as well. By slowing down and not texting while driving, you can prevent accidents and traffic violations.

It’s important to compare rates from both standard and non-standard auto insurance companies. There are companies who specialize in offering coverage to high-risk drivers and may be able to offer you a lower rate than you might find elsewhere. However, comparing quotes based on the same coverage amounts is essential so that you’re comparing apples to apples.